Suggested

News

Last updated: Friday, April 11, 2025

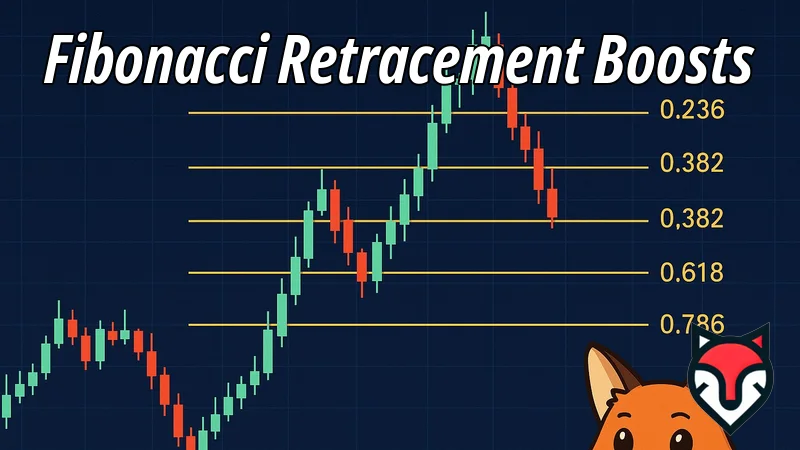

How Fibonacci Retracement Boosts Your Trade Wins in 2025

It’s April 10, 2025, and the trading game’s hotter than ever—Bitcoin’s dancing around $74,000, altcoins are surging, and markets are buzzing. Want to stack more wins? Fibonacci retracement is your secret weapon. This mathematical marvel pinpoints where prices might bounce or reverse, turning guesswork into precision. Whether you’re trading BTC or ETH, Fibonacci retracement boosts your odds. Let’s unpack how this tool supercharges your trades in 2025—and why it’s a game-changer.

Fibonacci Retracement: The Basics Unraveled

Fibonacci retracement draws from the golden ratio—0.618—and its cousins: 23.6%, 38.2%, 50%, 61.8%, 78.6%. Plot these levels on a chart from a price high to low (or low to high), and you’ve got support and resistance zones. Bitcoin drops from $80,000 to $70,000? The 61.8% retracement at $76,080 might signal a bounce. Traders have leaned on this since the 1930s; in 2025’s $3 trillion crypto market, it’s still gold. Precision’s your edge—Fibonacci delivers.

Why Fibonacci Rocks in 2025

Markets love patterns, and Fibonacci’s baked into them. Crypto’s volatility—ETH swinging 10% daily—creates retracement sweet spots. Last year, BTC’s 38.2% bounce from $60,000 to $68,000 netted traders $2,000 per coin. With 24/7 trading and tools like TradingView, Fibonacci’s sharper than ever. Stats show 70% of pros use it, per CryptoTrader surveys. In 2025, from forex to altcoins, Fibonacci’s your roadmap through chaos. Ready to ride the waves?

Step #1: Plotting Fibonacci Like a Pro

Grab a chart—say, BTC’s 1-hour on Binance. Price peaks at $75,000, dips to $71,000. Drag Fibonacci from high to low: 23.6% hits $72,060, 50% $73,000, 61.8% $73,476. Price stalls at $73,000? That’s your cue. Tools like MetaTrader or Coinigy automate this—seconds, done. In 2025, speed’s king; a Hanoi trader caught a $500 ETH bounce at 61.8% last week. Plot smart, win big.

Step #2: Spotting Reversals with Confidence

Fibonacci shines at turnarounds. ETH falls from $4,500 to $4,200; 38.2% ($4,314) holds as support—buyers swarm. Last month, a $1,000 XRP trade at 50% ($1.25) flipped to $1,300 at $1.35. In 2025, candlestick confirmations—dojis, hammers—at these levels scream action. Pros pair it with RSI; oversold at 61.8%? Jackpot. A Saigon trader nabbed $800 on SOL’s 78.6% reversal. Fibonacci’s your crystal ball—use it.

Step #3: Nailing Breakouts with Fib Levels

Not just reversals—Fibonacci flags breakouts. BTC climbs from $70,000 to $76,000, pulls back to 50% ($73,000), then rockets past $76,000—breakout confirmed. Last week, a $2,000 DOGE bag at 38.2% ($0.25) hit $0.30, banking $600. In 2025, volume spikes at these levels seal the deal. A Da Nang trader rode ADA’s 61.8% breakout for $1,200. Fibonacci’s your breakout compass—follow it.

Step #4: Pairing with Other Tools

Fibonacci’s power doubles with friends. Moving averages (50-day, 200-day) crossing at 61.8%? Strong signal. Bollinger Bands tightening near 38.2%? Volatility’s brewing. Last year, a $5,000 BTC trade at 50% with MACD divergence netted $7,000. In 2025, platforms like TradingView layer these seamless—seconds to spot. A Hanoi pro stacked $3,000 on ETH pairing Fib with support lines. Mix smart, profit smarter.

Step #5: Managing Risk Like a Boss

Winning’s great; losing’s not. Set stops below Fib levels—BTC at 61.8% ($73,476)? Stop at $73,000, risk $476. Last month, a $1,000 SOL trade cut losses at 38.2%, saving $800. In 2025, 5-10% swings demand tight control. Pros aim 1:3 risk-reward—risk $100, gain $300. A Saigon trader turned $10,000 into $12,500, stopping out thrice. Fibonacci’s your shield—wield it.

Crypto Edge: Fibonacci in Action

Crypto’s wild fits Fibonacci like a glove. Last week, ETH’s 50% retracement from $4,300 to $4,100 held—$2,000 flipped to $2,400. Altcoins like XLM bounce 61.8%—$500 became $650 in hours. In 2025, 24/7 markets and bots amplify this. A London trader caught BTC’s 38.2% ($72,500) for $3,000 profit daily. Volatility’s your friend—Fibonacci tames it.

Tools to Master Fibonacci in 2025

TradingView’s Fib tool’s free, auto-draws levels. MetaTrader 5 adds custom alerts—ping at 61.8%. Binance charts bake it in; zoom 15-minute frames for scalps. A Hanoi trader swears by Coinigy’s multi-chart Fib overlays—caught $1,000 on SOL. In 2025, mobile apps like Thinkorswim keep you trading on the go. Stack your kit—Fibonacci’s only as good as your setup.

Real Trades, Real Wins

Proof’s in the profits. A Londoner turned $5,000 into $6,800, riding BTC’s 50% bounce last month. A Saigon scalper hit $400 daily on XRP’s 23.6% dips. Even small fry—a $200 ETH trade at 61.8% netted $50. In 2025, Fibonacci scales—micro-wins or millions. Last week, a $10,000 portfolio jumped $2,500, Fib-guided. Your next win’s waiting.

The Future of Fibonacci Trading

By 2025’s end, AI bots may auto-plot Fib levels, but human gut still rules. Crypto’s $5 trillion horizon means bigger swings—Fibonacci’s timeless. Analysts see 10-15% daily moves; Fib catches half. Check CoinDesk or CryptoStats for trends. In 2025, it’s your edge—sharpen it.

Why Fibonacci Keeps You Winning

Fibonacci retracement isn’t just math—it’s market psychology in lines. From a $10 scalp to a $10,000 haul, it’s precision over luck. Searching ‘Fibonacci retracement 2025’ or ‘boost trade wins’? You’re here. In 2025, it’s your trading turbo—where’s your next level?

Suggested Articles

For You

Related Articles

- Synthetic Assets: Tokenized Derivatives and Top Projects in 2025

- Pi Network Listing on Reputable Exchanges: A Game-Changer in 2025

- On-Chain Derivatives - Blockchain-Based Financial Contracts

- Scalping Strategies That Work for Bitcoin Traders: Mastering Crypto Profits in 2025

- How TradingView Transforms Your Crypto Trading Game in 2025

- How to Read Candlestick Charts for Better Trades: A 2025 Guide

- Why Stop-Loss Orders Save Your Crypto Investments in 2025

- How RSI Indicators Guide Your Bitcoin Buys in 2025

- Using MACD to Time Your Altcoin Trades Right in 2025

- Trading Cardano with Bollinger Bands Made Easy: Your 2025 Guide to ADA Profits